Peerless Tips About How To Get A Good Faith Estimate

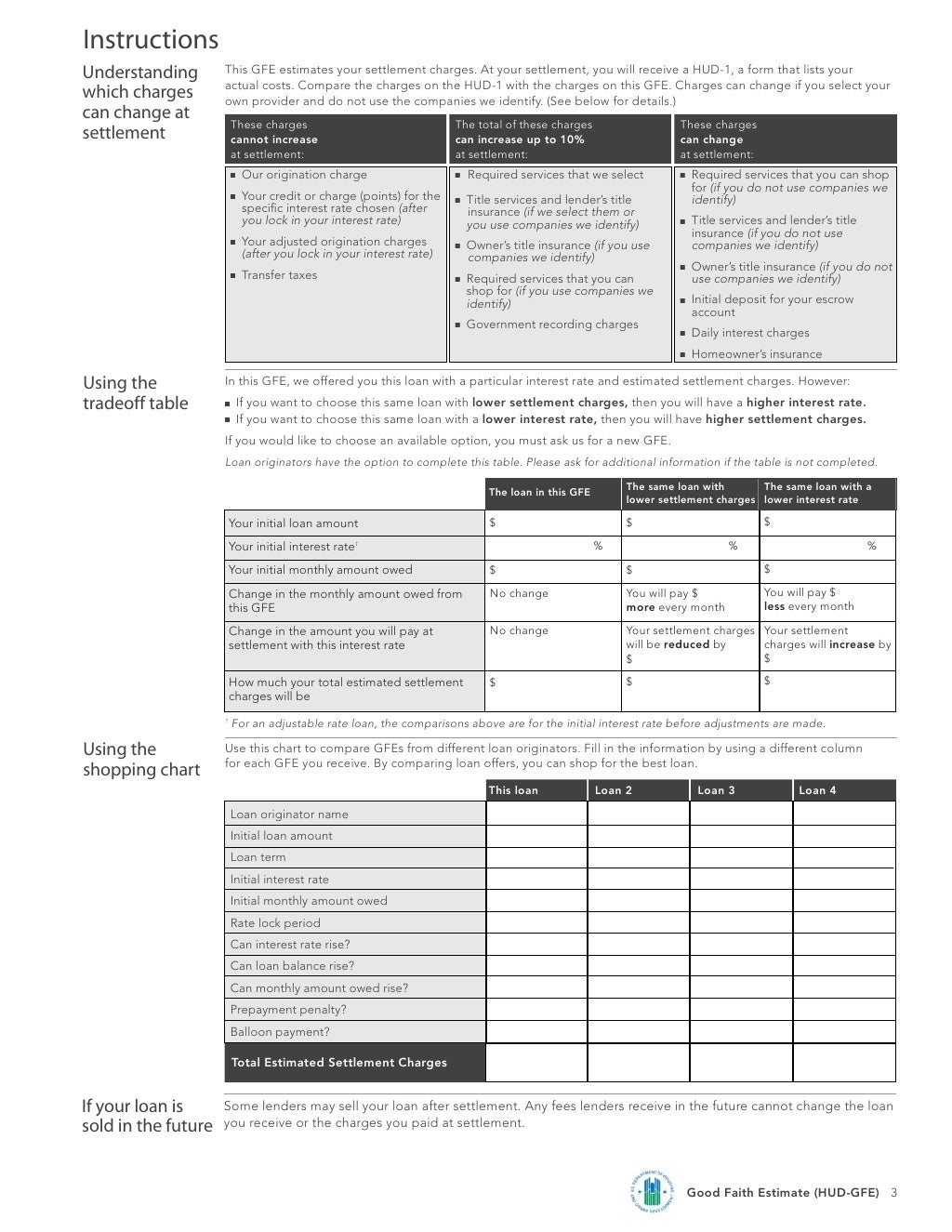

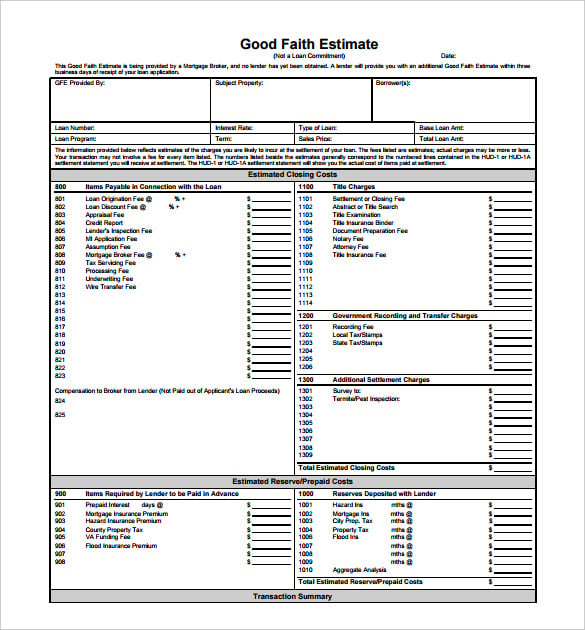

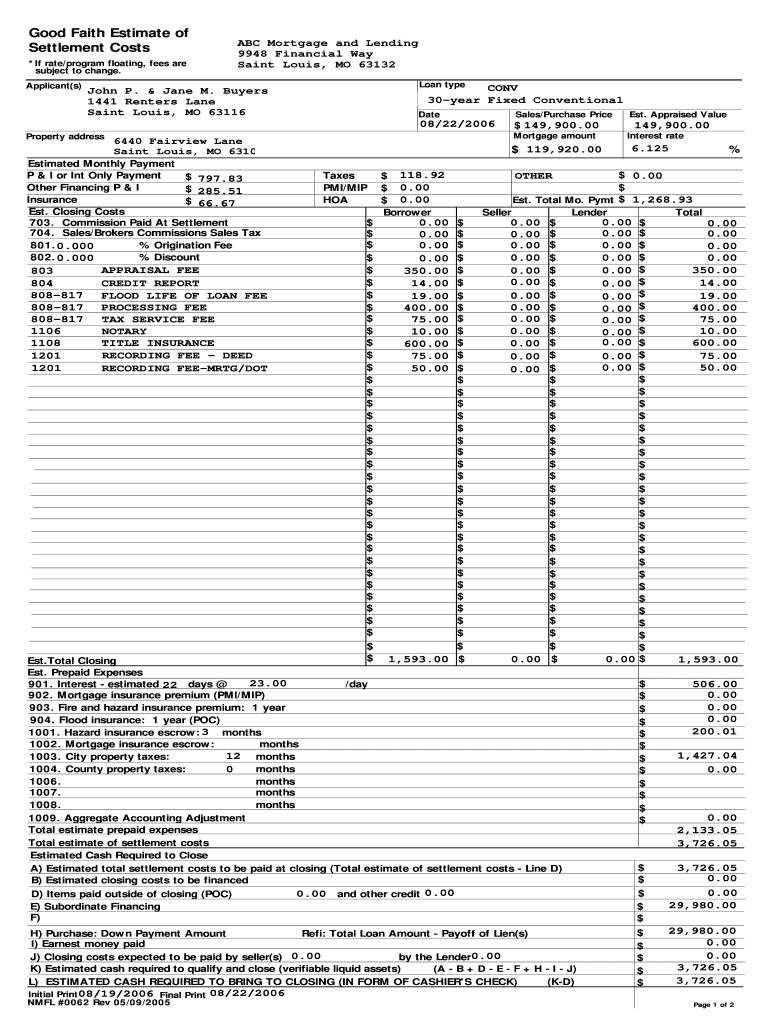

Note that a good faith estimate, sometimes known as a gfe, is a standardized form that contains a long list of the terms and conditions of your.

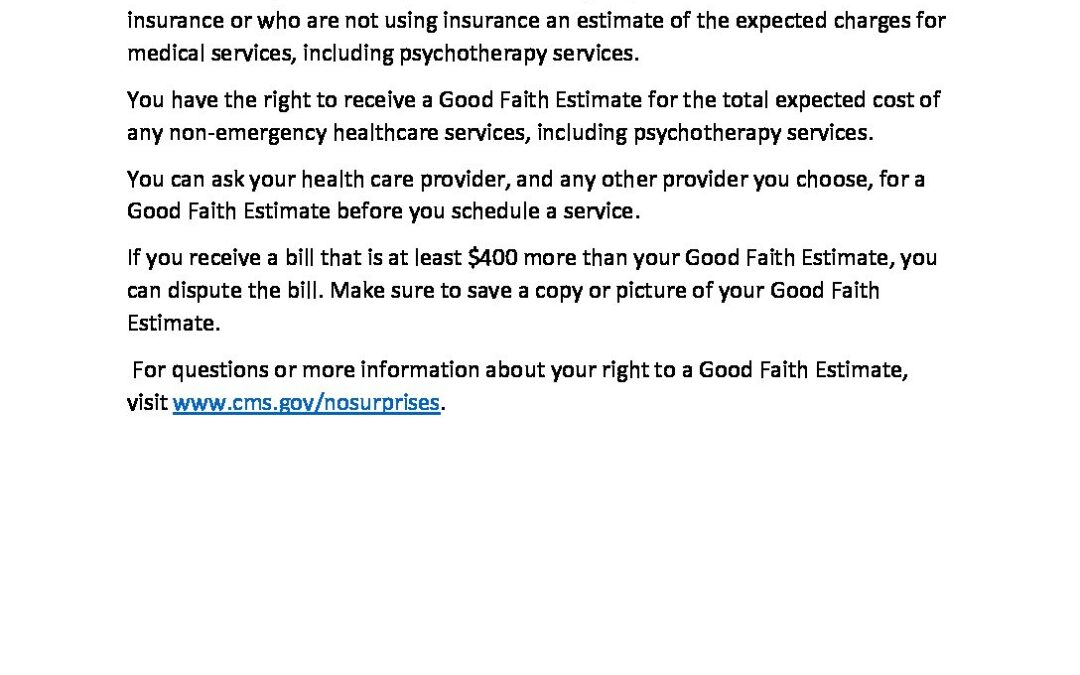

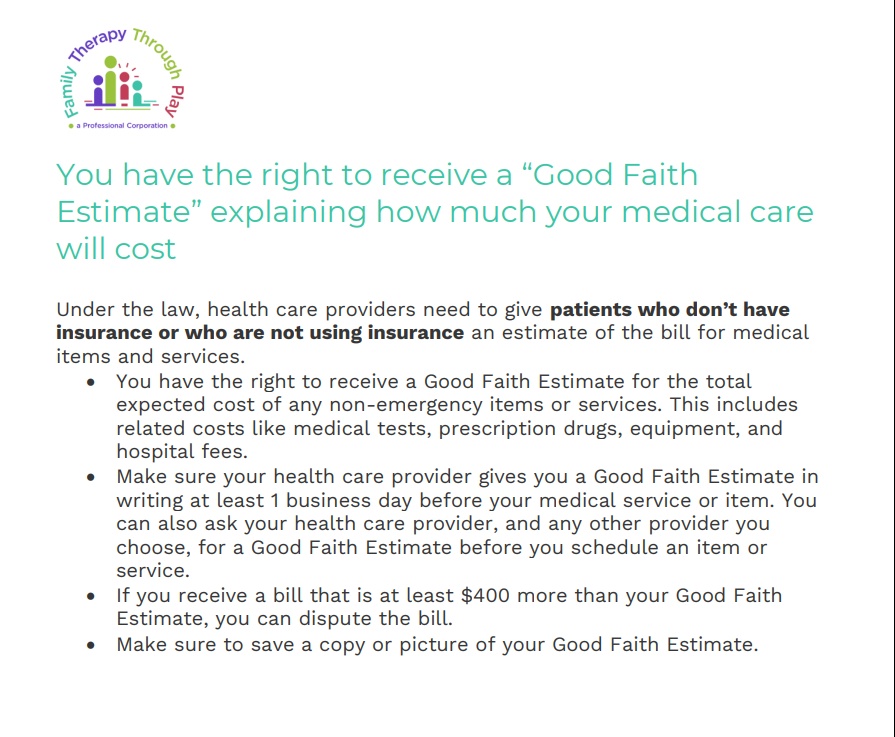

How to get a good faith estimate. Under the no surprises act, you must supply the good faith estimate form to all. Good faith estimates for patients. Surprise billing requirements, such as the good faith estimate (gfe), can be daunting.

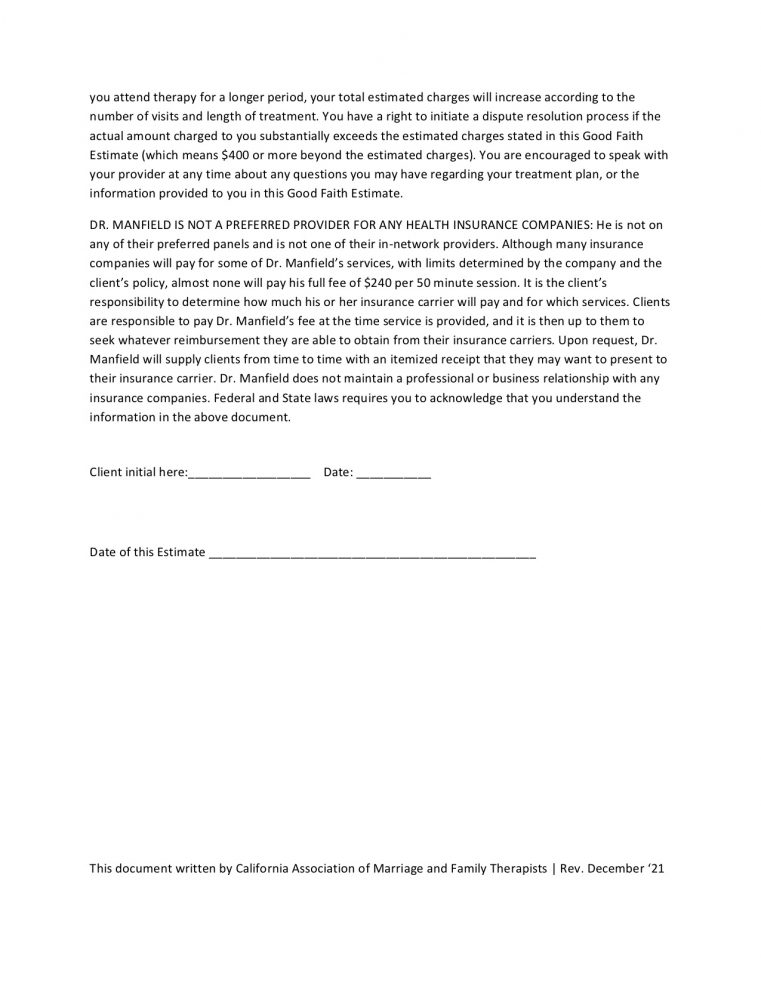

Faqs on the no surprises act and good faith estimates. What is a good faith estimate? If you end up changing the expected charges, items, services or costs that you put on an estimate within that 12 month period, you must send the patient an.

A good faith estimate (gfe) is a document that outlines the estimated costs and terms of a reverse mortgage loan offer, enabling borrowers to comparison. But now is the time for physician and hospital leaders to ensure compliance. The gfe lists basic information about the.

Dec 29, 2022 when you’re in the midst of the home buying process, you’re likely focused on the big picture of finding the right home for you. Understanding the nuances of the no surprises act good faith estimates. That means it should be based on the services or treatments a provider reasonably expects to offer.

You should get a good faith estimate if you schedule an appointment at least 3 business days in advance. Previous to 2015, a good faith estimate was one of two documents you received upon submitting a mortgage application. A good faith estimate, also called a gfe, is a form that a lender must give you when you apply for a reverse mortgage.

Passed in 2020 and effective january 1, 2022, the no surprises act contains provisions. To generate a good faith estimate for a specific client: You can ask your provider directly for an estimate if they don’t give one to you.

You will need to submit a copy of your bills and the written good faith estimate to file the dispute. Navigate to the client’s overview page click new > good faith estimate A good faith estimate is not a bill, so the actual cost of a.

About the good faith estimate (gfe), including how they work and how to use them. A good faith estimate is an estimate, not a guess. A good faith estimate (gfe) is a financial document that shows the expected charges for healthcare services provided to uninsured individuals and those.

Use today's gfe to help compare rates among lenders. You have the right to receive a “good faith estimate” explaining how much your medical care will cost. A good faith estimate is a list of expected charges before you get health care items or services (procedures, supporting care) from a provider or facility.

Here are some basic steps you need to take to start complying with the no surprises act good faith estimate (gfe) requirement for patients who are uninsured or.

![Good Faith Estimate Form [Template] For Therapists Belongly](https://www.belongly.com/wp-content/uploads/2023/04/Good-faith-Estimate-Form-1200x1553.jpg)