Top Notch Info About How To Claim Child Care Credit

The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

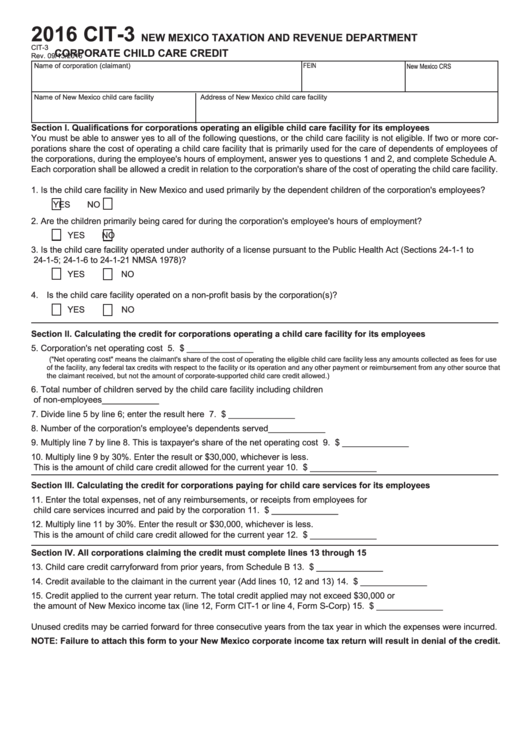

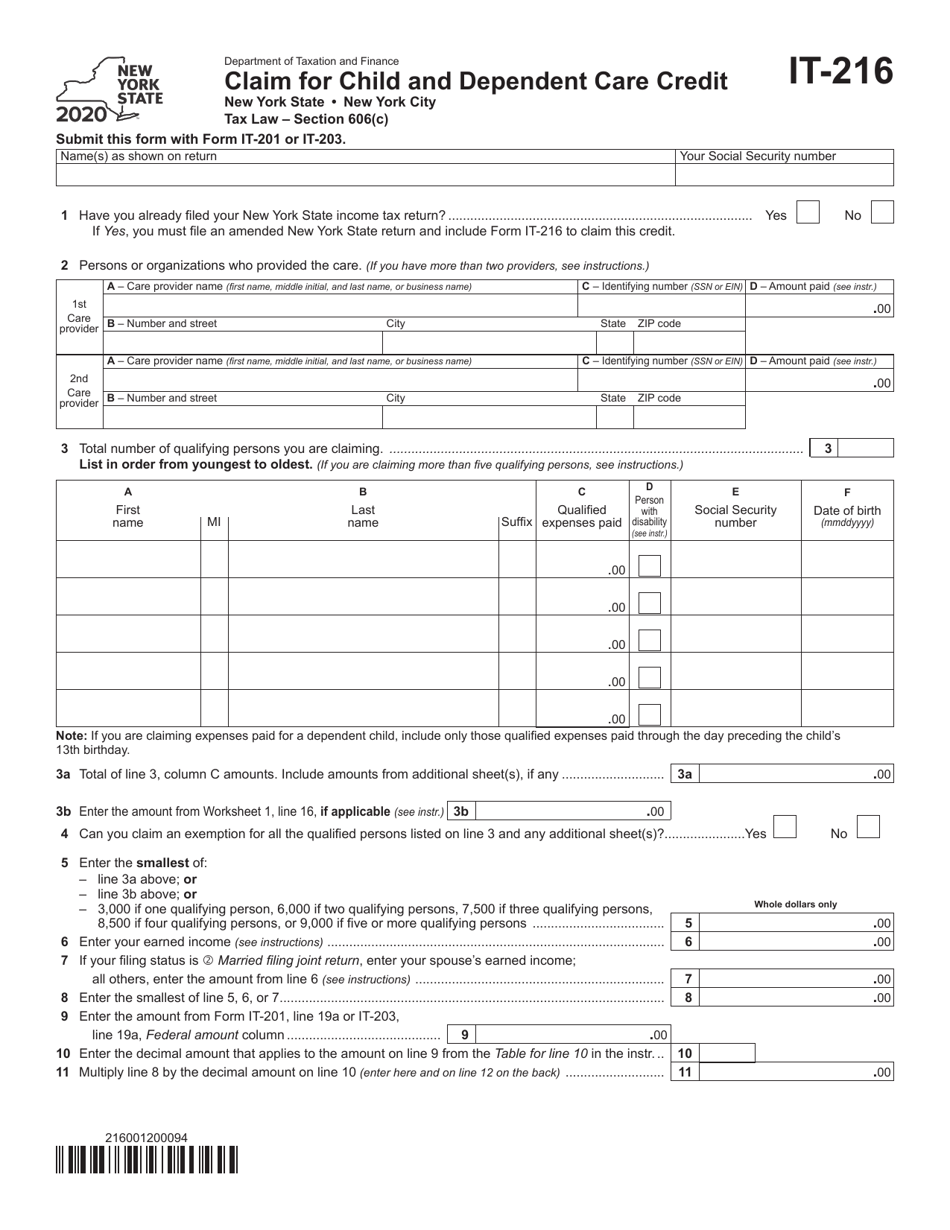

How to claim child care credit. Like dependent care fsas, the dependent care tax credit is for care expenses for. Overview if you are paying someone to take care of your children or another person in your household while you work, you might be eligible for the child and. Part of get childcare:

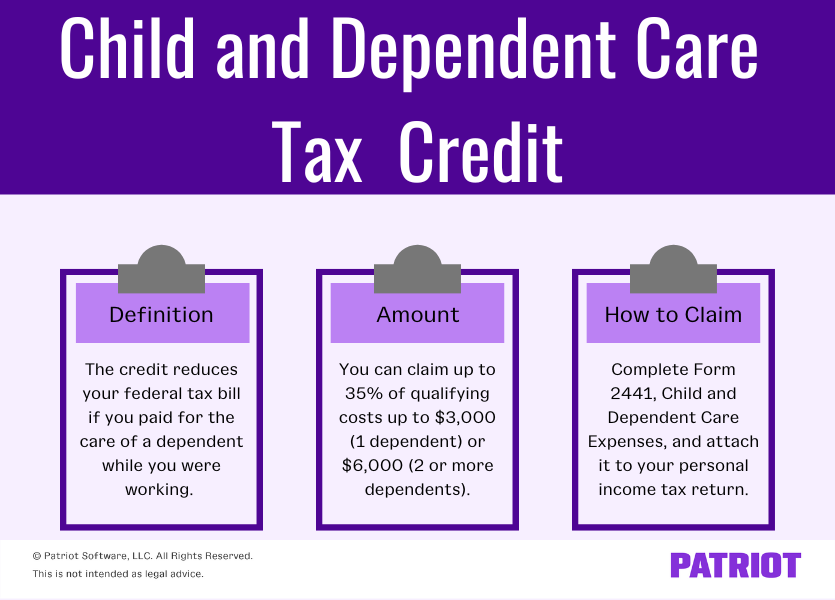

If you spent $12,000, you can claim 20% of your first $10,000 in costs, or. The child and dependent care credit helps you pay for the care of qualifying dependents, such as children under 13 or other dependents unable to care. The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on.

This tax season, an often overlooked tax credit could put up to. The american rescue act also increased the rate. To claim the credit, you will need to complete form 2441, child and dependent care expenses, and include the form when you file your federal income tax return.

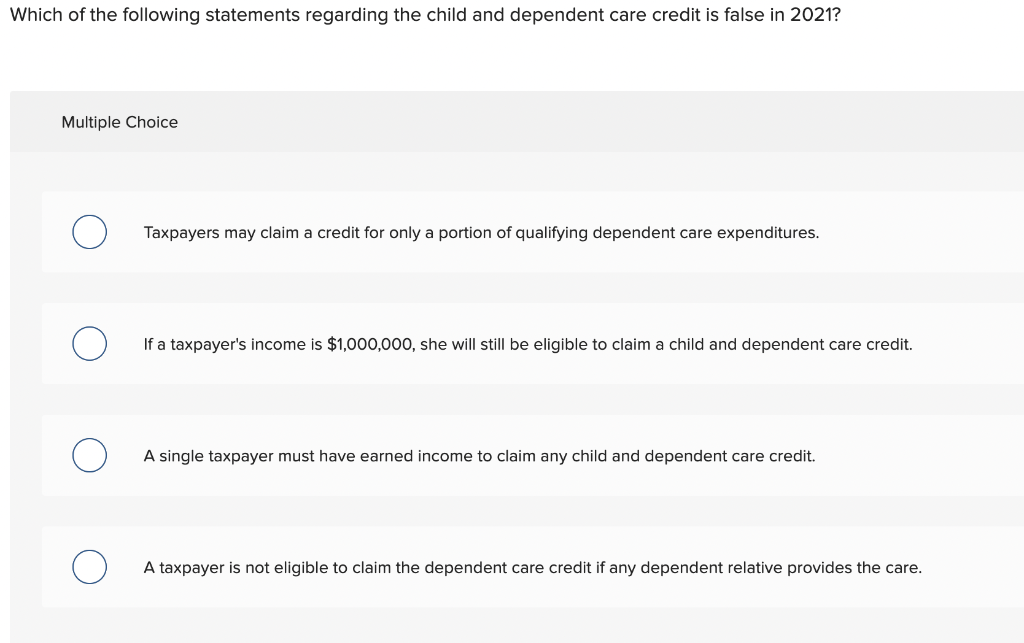

Only a portion is refundable this year, up to $1,600 per child. The american rescue plan signed into law on march 11, 2021, brought significant changes to the amount and way that the child and dependent care credit. The child and dependent care tax credit (cdctc) is a tax credit of up to 35% of what you pay someone to take care of your children or adult dependents who.

The child’s parent (or main carer) agrees to your application by counter. A qualifying person is a dependent under. Contact hm revenue and customs ( hmrc) to check.

The maximum amount of the. Follow these steps to get to the child and dependent care credit in turbotax. In completing the form to claim the credit, you will need to provide a valid.

The dependent care tax credit is a tax benefit based on childcare expenses. The child’s parent (or main carer) has claimed child benefit but does not need the credits themselves. Households with two or more children can claim up to $16,000.

Other general tax credits. Many changes to the child tax credit (ctc) that had been implemented by the american rescue plan act of 2021 have expired. As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200.

Take advantage of the 2021 child care credit and receive a refundable tax credit of up to $8,000. Your eligibility to claim the child and dependent care credit will depend on the amount you paid to care for a qualifying child, spouse, or other dependent. If you're not in your return already, sign in to turbotax and select either review/edit or pick up.

Step by step tax credits and childcare if you already claim tax credits, you can add an extra amount of working tax credit to help cover the cost of.