Brilliant Tips About How To Choose A Depreciation Method

:max_bytes(150000):strip_icc()/Term-Definitions_depreciation-6a519480f170442fba6cf542a1a3e023.jpg)

(2 x 0.10) x 10,000 = $2,000.

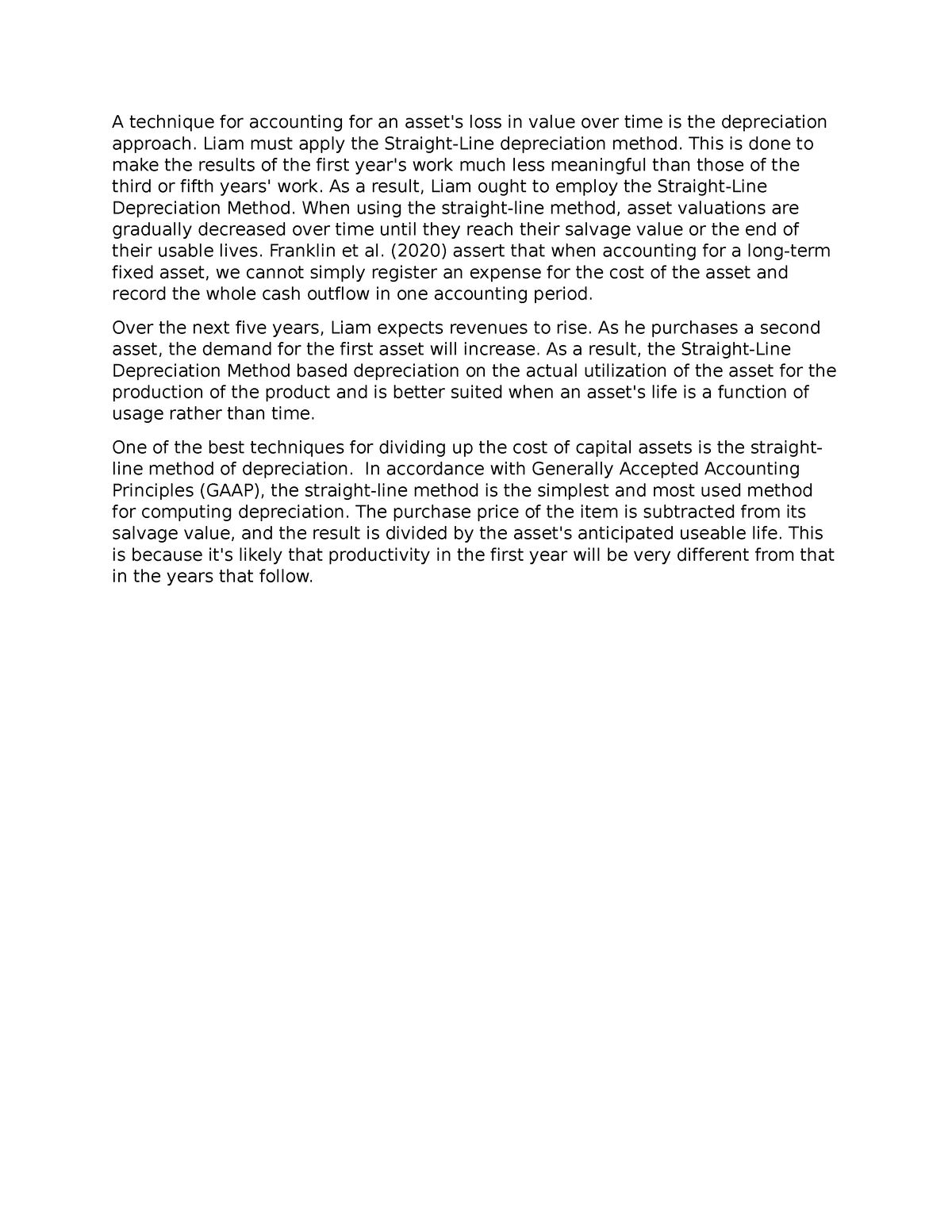

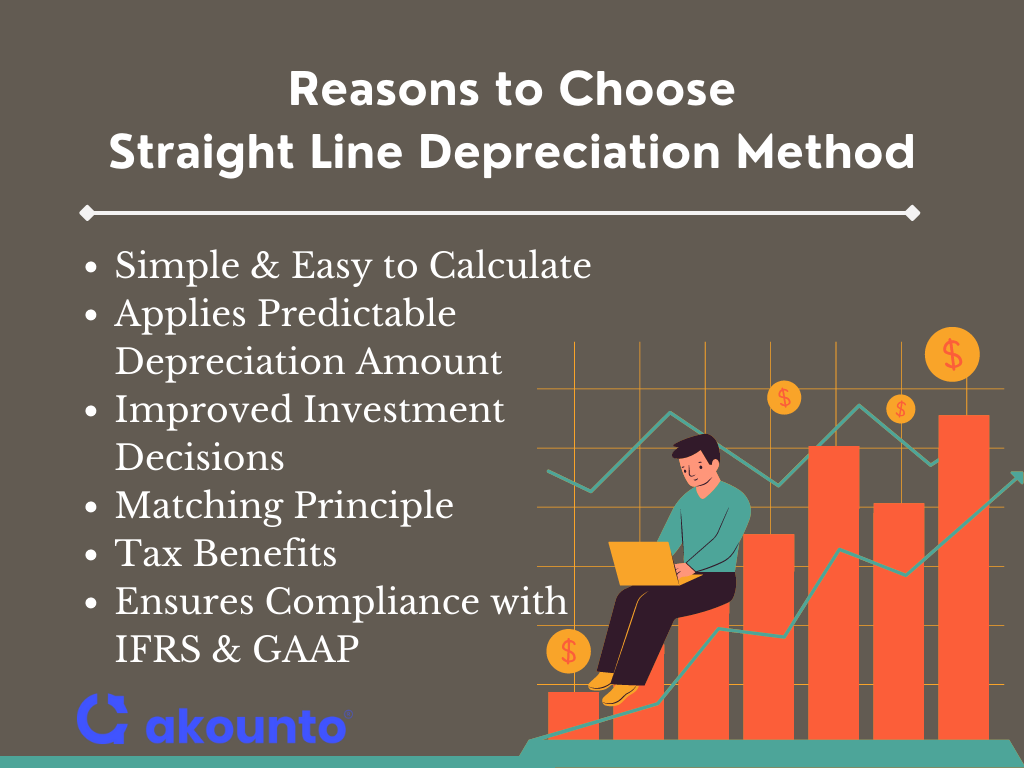

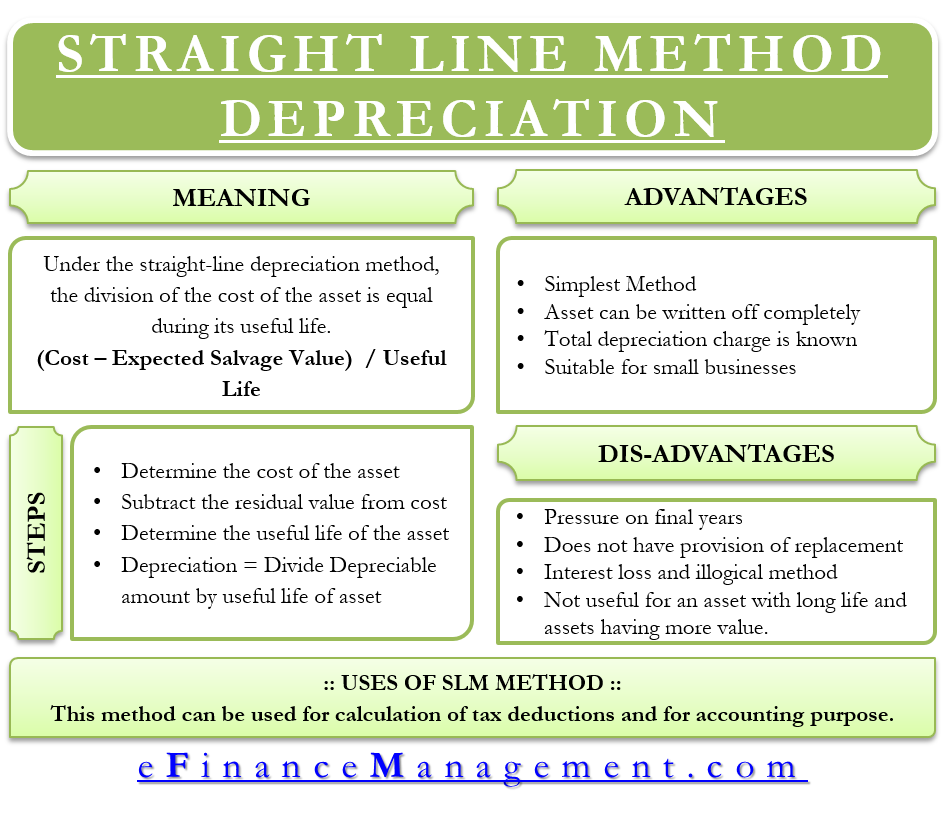

How to choose a depreciation method. Choosing the right depreciation method involves considering factors such as the asset’s useful life, salvage value, and industry standards. Here are four easy steps that’ll teach you how to record a depreciation journal entry. If you use the asset heavily in its early years, you should.

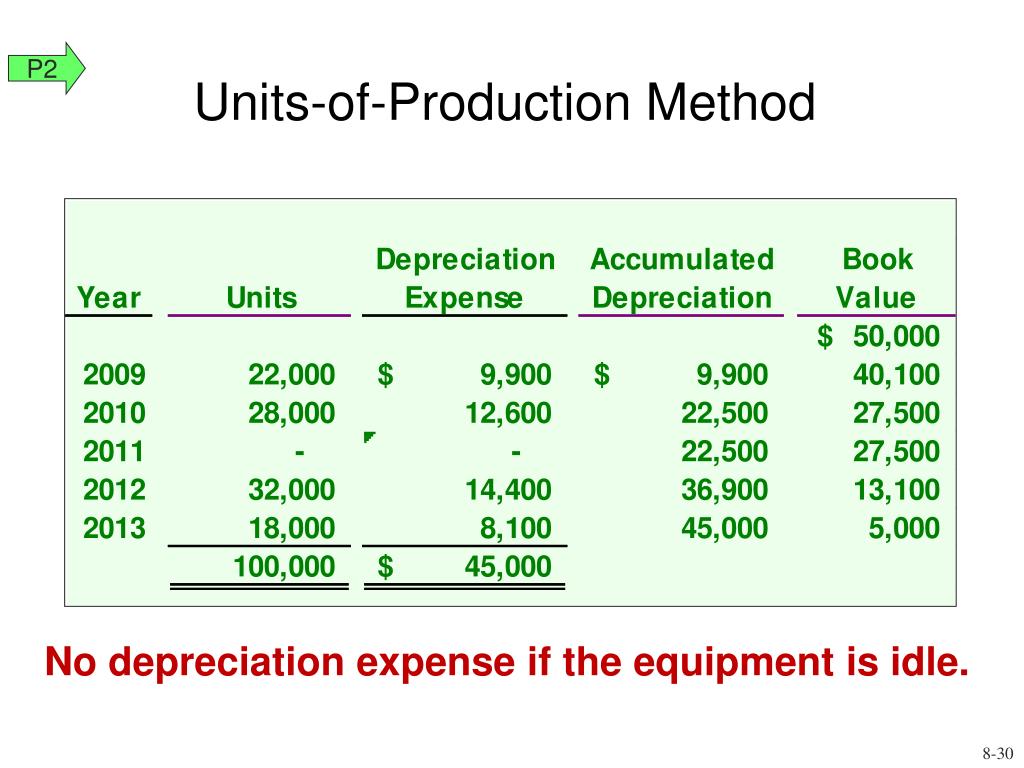

The units of production method is based on. This only works if you’re profitable and you must affirmatively elect the. This is the most commonly used method to calculate depreciation.

Generally, you adopt a method of accounting for depreciation by using a permissible method of determining depreciation when you file your first tax return, or by using the. You’ll write off $2,000 of the bouncy castle’s value in year one. There are different methods of accelerated depreciation, including:

These more flexible options will also be available for recording asset purchases on the go using the freeagent mobile app. Multiply that number by the book value of the asset at the. Units of production depreciation writes off.

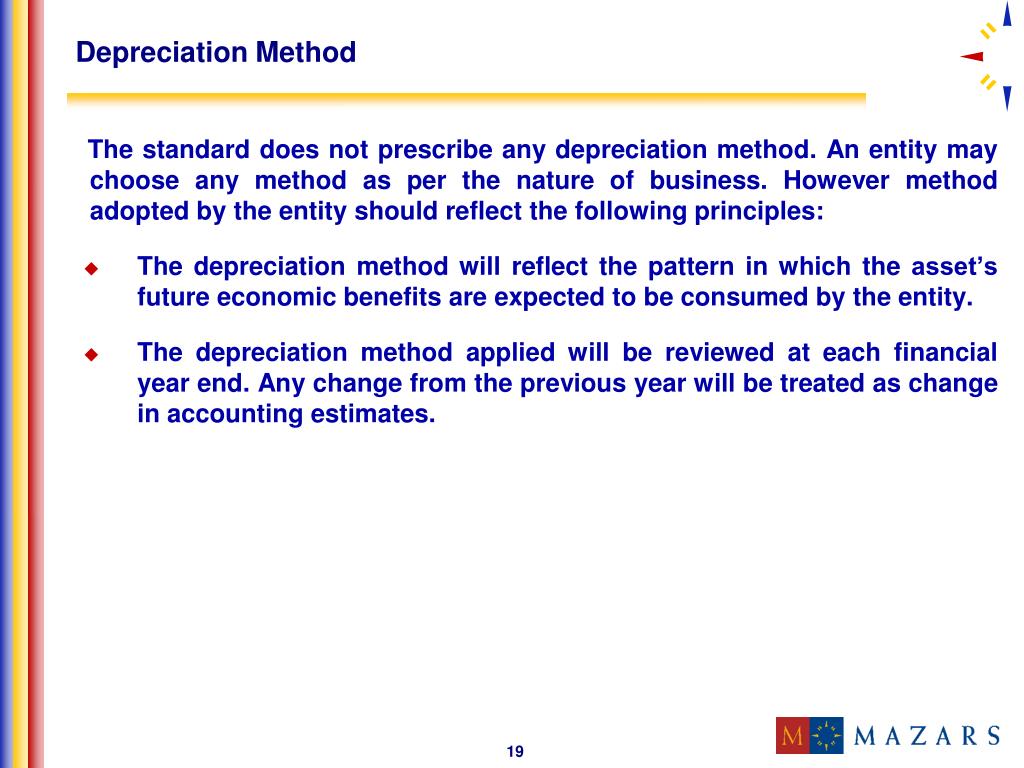

A company may also choose to go with this method if it offers them tax or cash flow advantages. Bookkeeping what is depreciation and how is it calculated? Individual businesses may choose various methods.

You should choose depreciation methods depending on how you choose to use the asset. If your asset is a machinery or plant that works best during the initial years of its useful. April 21, 2022 depreciation is the gradual decrease in the value of a company’s assets.

The depreciation method you choose should relate to how you use the asset to generate revenue. Different types of property have specific recovery periods and rules for. To calculate using this method:

How to choose a depreciation method straight line depreciation spreads the cost evenly over a number of years. If you use the asset heavily. Common depreciation methods.

Macrs depreciation tables help you write off the cost of business assets on your taxes. The depreciation method you choose should relate to how you use the asset to generate revenue. Depreciation rates directly affect the way that a business operates.

When depreciating an asset using the. It is also known as fixed instalment method. Accelerated depreciation writes off a greater portion of the cost in early years and a smaller portion in later years.

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)