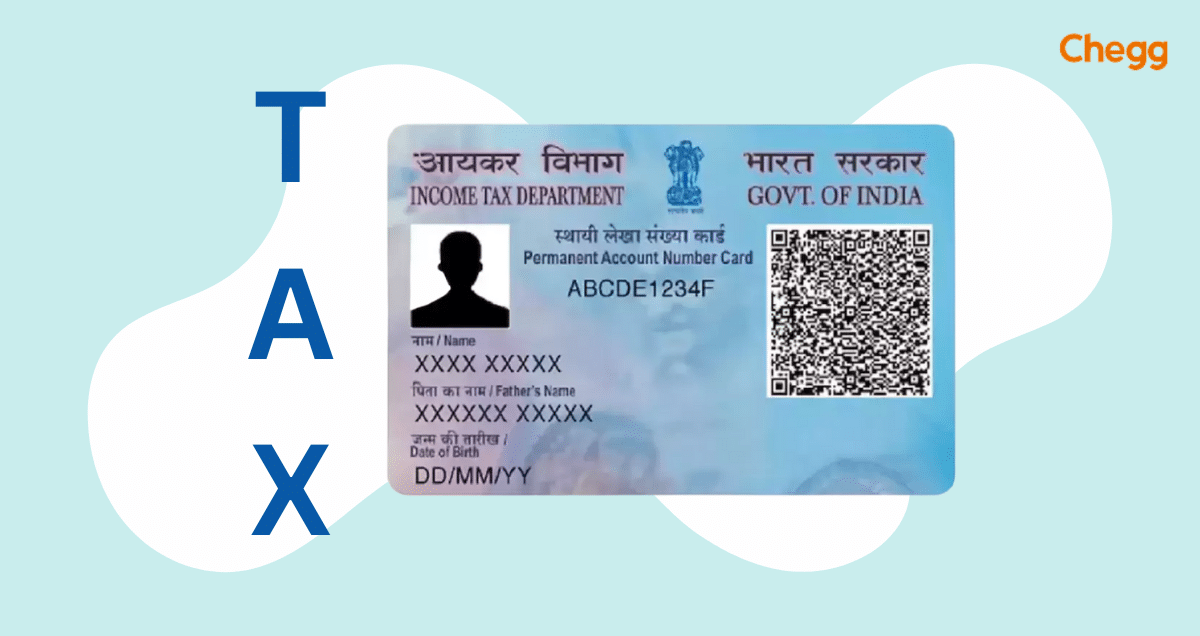

Real Info About How To Apply For Vat Number In India

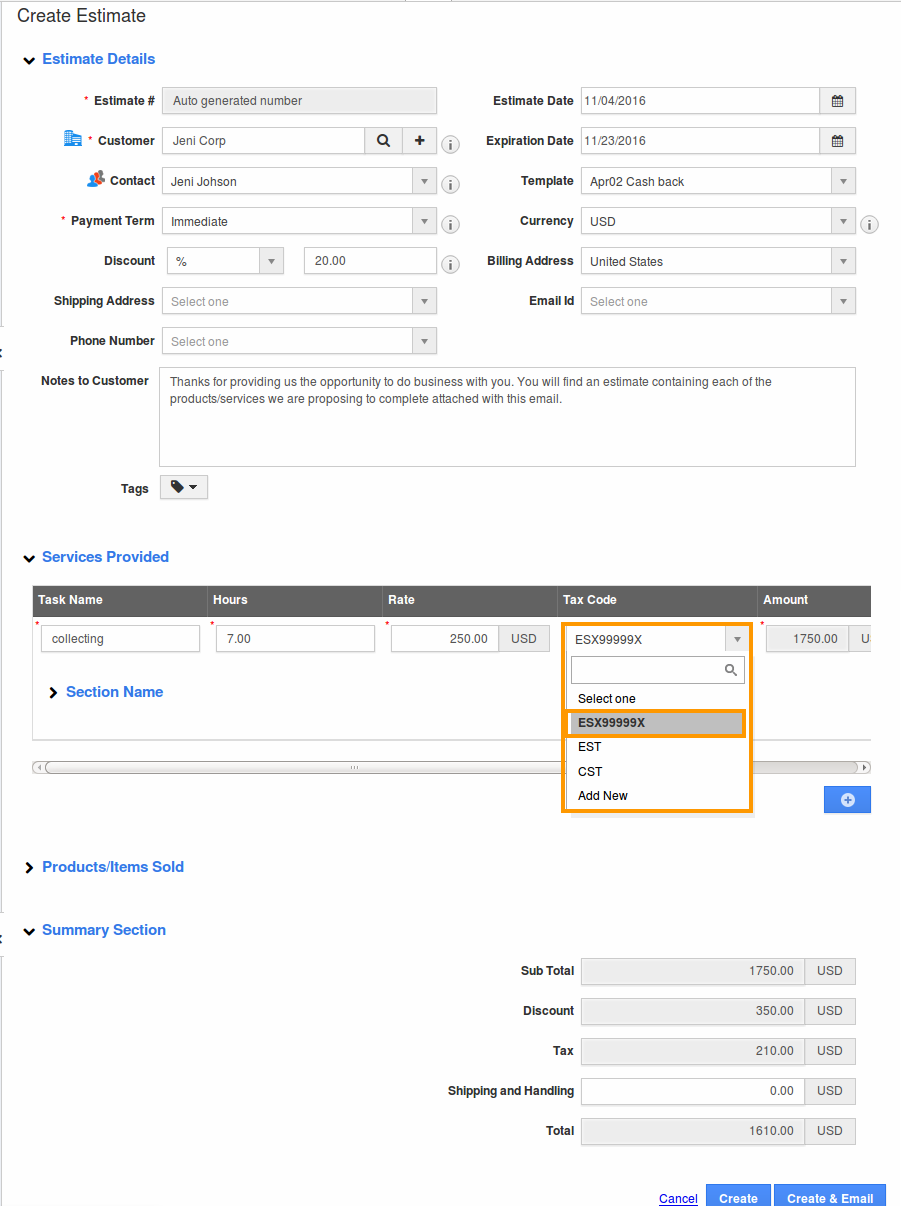

Fill all the relevant details and also attach scanned copies of the required documents.

How to apply for vat number in india. Add information and attach documents as request for your company. Determine whether you are registering as an individual, an agent, or an organization that is established in the state of application. Tin application process.

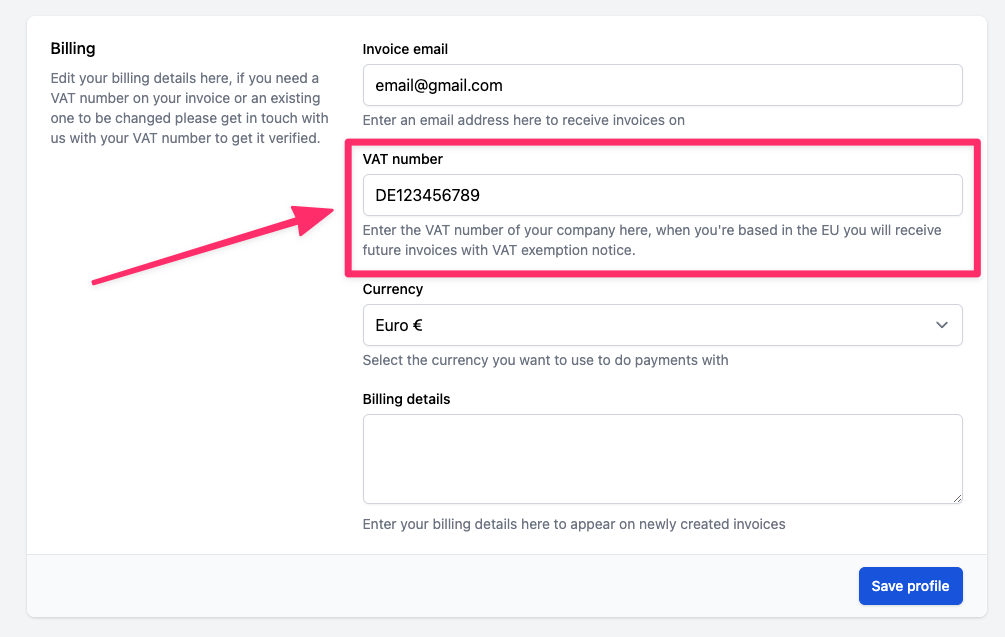

Information about documents required and guidelines to fill the form is given. You must be established in the. Value added tax (vat) registration is a tax registration required for businesses trading or manufacturing goods in india.

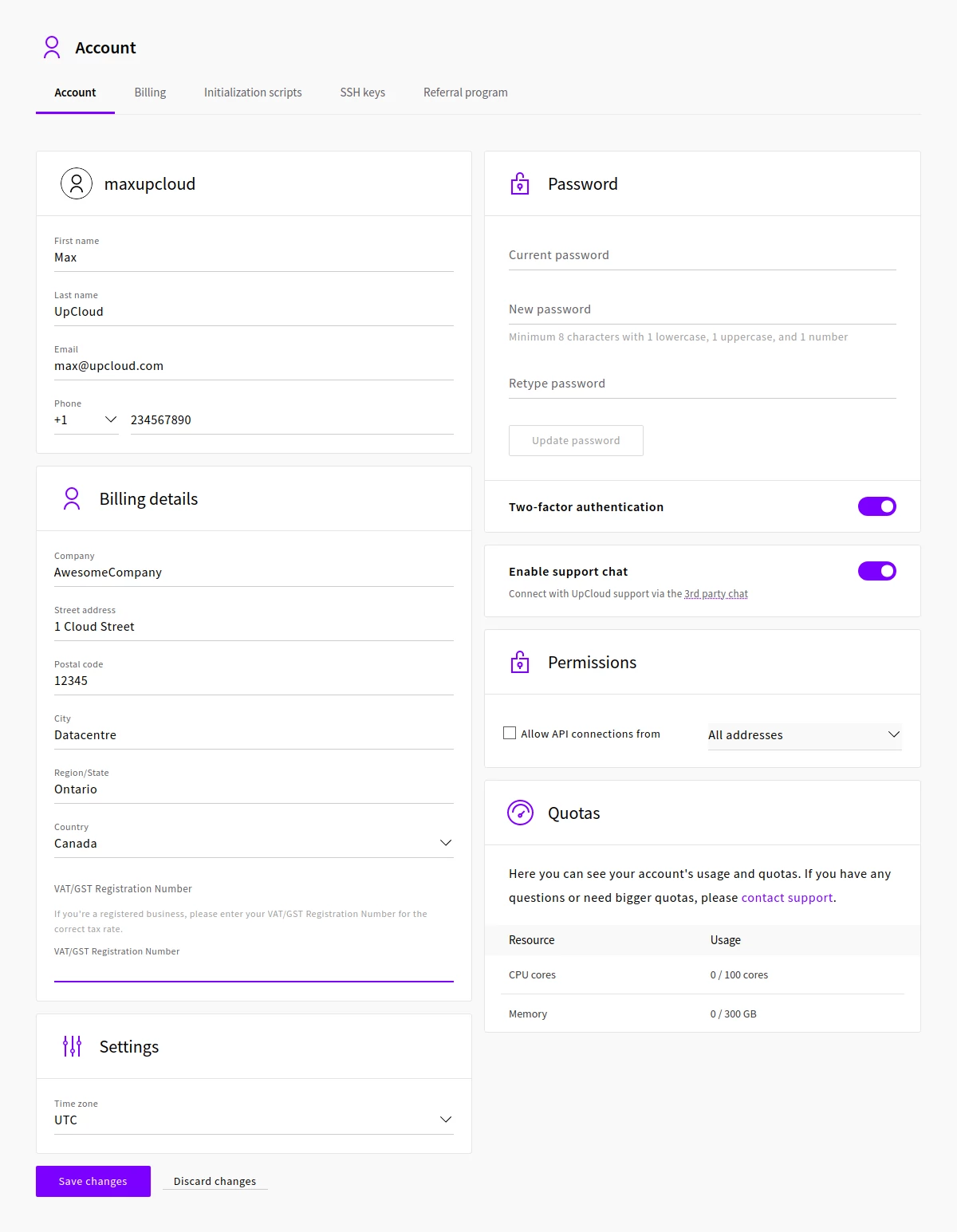

As per the state government, sign on to the respective vat portal with your unique login id. It has been a popular source of information to a wide range of. Log on to your state’s vat website and then click on the.

Know more about vat in punjab, vat rates, registration online/offline process, documents required, registration fees, vat different from gst and other. Fill up the application form and provide the required details. Documents required for tin registration.

Input tax is payable by the seller of goods and services for. Visit the official vat website and after logging in click on the registration tab. The online procedure for obtaining tin is as follows:

There is a simple formula to calculate vat by subtracting the input tax from the output tax. The application for the allotment of a tin can be made both offline and online. Your unique taxpayer reference ( utr) details of your annual turnover.

Value added tax and its application in india. Online vat registration procedure: To register for vat, exporters, manufacturers, merchants, and dealers of goods.

The vat registration online india entails the following steps: Every small or medium enterprise intending to sell goods or services. For the first standard vat rate (18%), multiply the original price by 1.18.

The tin is used to sell and acquire goods and services inside and across states. Apply for vat registration in goa provided by the commercial taxes department of the state. Vat registration replaced sales tax in india and is.

Your business’s bank account details. Vat registration can also be done via the online method. For the reduced rate (5%),.